by Carolyn Ford

Income share agreements (ISAs) are gaining traction among students as a means of funding higher education.

In this blog post, Carolyn Ford explores the pros and cons of ISAs. She also describes how to compare an ISA to a traditional loan.

As students accept offers of admission and prepare to arrive on campus, they usually take stock of their capacity to cover the costs of their degree through personal financial resources, employment, institutional financial aid, private or government-sponsored awards, or loans. This is a complex decision.

To these financial options, students can now add the possibility of the ISA.

What Is an ISA?

Colleges and universities across the U.S. and Canada are rolling out ISA programs as an alternative to student loans. Two of the most recent examples of institutions offering ISAs to students include The University of Utah and Purdue University. Institutions may create ISAs in house or partner with third-party financial firms to create and administer their ISAs.

An ISA is a legally binding contract between the student and the new institution. In exchange for a commitment to pay a percentage of future earnings, the student receives credit in their student account today that covers all or a portion of their tuition.

Like a loan, the student is obligated to make monthly payments (after graduating) until they pay off the ISA amount.

The key difference between an ISA and a traditional student loan is that the monthly amount students pay post-graduation is dependent upon future income.

ISA payback rates vary by school, program, and major. Majors with lower starting salaries will have a longer-term and a higher payback rate.

Is an ISA right for you? In this blog post, I explore the factors you should consider.

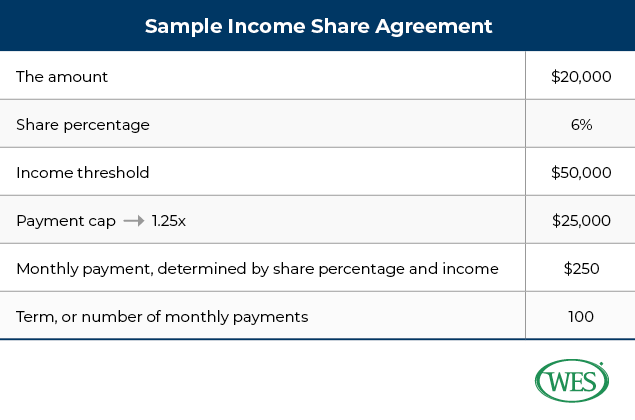

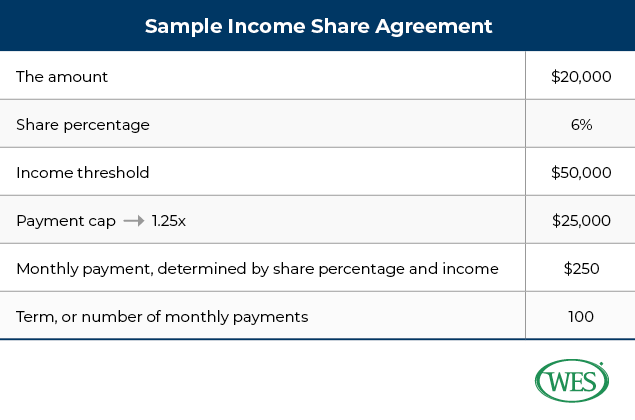

Specific terms and conditions include:

- The amount

- The share percentage of the future graduate’s income

- The income threshold: Earn the threshold or more and the requirement to pay the share percentage begins. If a graduate is earning less than the threshold, then the requirement to pay is not triggered.

- The payment cap: An amount in multiples of the agreed amount that the graduate repays. In the case of a 1x cap, the graduate is re-paying the same amount of funds they received in their student account. Payment caps of 1.5x or up to 2.0x may also be possible.

- The term: The maximum number of payments to be made. The term is usually expressed as the number of monthly payments.

These last three items—the threshold, the payment cap, and the term—should be very clear in the terms and conditions of the contract to limit the downside risks to the student of entering into this kind of commitment.

Further Reading

Other possible terms:

- Grace period: A set period of time post-graduation that enables the new graduate to find a job and get their lives set up before beginning to make payments.

- Buyout clauses: The terms and conditions that would enable the graduate to make a lump sum payment that removes further requirements to pay and thereby closes out the ISA.

Benefits of an ISA

The main benefit of an ISA is the opportunity to focus on one’s studies without immediate pressing financial concerns. With an ISA, the student is converting their future potential into current financial capital, completing their degree in a timely manner, then repaying the amount once capable of doing so. If you are unemployed at any point, you do not need to make any payments; your ISA resumes as soon as you begin working again.

Risks to Avoid

Since ISAs are a new financial instrument, students must take care to consider the jurisdiction in which they are signing the agreement. From one year to the next, the body of knowledge about ISAs will continue to grow as will the number of institutions creating them.

In each instance, a student considering an ISA is advised to compare and contrast the money repaid via an ISA and via a specific loan. In some cases, the terms and conditions of an ISA will leave the student better off financially than under loan conditions, while in other instances the loan may still provide the better option.

A Sample ISA

The student signs an ISA and receives a $20,000 credit in their student account. Then, after graduation, if the new graduate is earning the income threshold of $50,000 or higher, they will pay 6% of their gross salary to the institution. With a payment cap of 1.25x, the maximum amount paid will be $25,000. At payments of $250 a month, the graduate will have paid off the ISA gradually over 100 months or just over 8 years.

Key Takeaway

In order to determine whether an ISA or a loan is right for you, it is helpful to mock up the terms and conditions of each in a spreadsheet. Also, try exploring comparison tools such as Purdue’s or The University of Utah’s. These tools help you compare the monthly and total payment amounts of an ISA versus a private or public loan. You may also want to check out this glossary of ISA terms to learn more!

Source: WES.org

No comments:

Post a Comment