by IDP

In this, the first of a three-part series, we will take you through the ins and outs of the International English Language Testing System (IELTS). We will talk about who should take the IELTS, what the test is, where you can take the test, why you need it, and when you can expect your results.

In future installments, we will talk about how you can best prepare for the test and what to expect on the day of the test.

Now that you have decided to study in or migrate to an English-speaking country, how can you demonstrate your language skills?

Having a standardized English test score may be important for you if you are applying to an academic institution in a country where English is the official language. It could also be important if you are migrating to an English speaking country. IELTS is a reliable and internationally recognized test score that can help you to achieve your goals.

What is IELTS?

IELTS was developed in the 1980s to test an individual’s English language proficiency.

IELTS is jointly owned by the British Council, IDP: IELTS Australia and Cambridge English Language Assessment. The combined expertise of these three international partners is what makes the test secure, reliable, and the most popular high-stakes English-language test. The test assesses the English language levels of people whose language skills range from beginner to expert in four language areas. Here are a few details about the IELTS:

- International:

- IELTS is accepted in 140 countries.

- The test provides results to more than 9,000 institutions and organizations worldwide.

- The results can be used for work, study, or migration purposes.

- English skills assessment:

- Listening

- Reading

- Writing

- Speaking

- Testing info:

- There is a nine-point band scale that allows you to demonstrate how accurately you can use your English skills.

- The entire test takes 2 hours and 44 minutes.

- In most cases, you will be able to complete all four sections of the test on the same day, but you may have to take the speaking portion of the test on another day.

- System:

- There are a range of scores that you can obtain in each of the four skill areas.

- Four different aspects are considered in the writing and speaking areas.

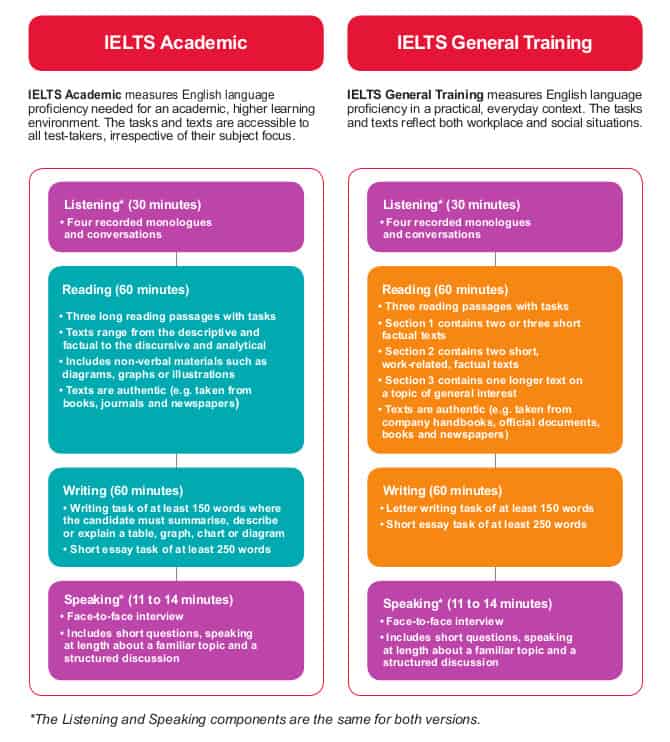

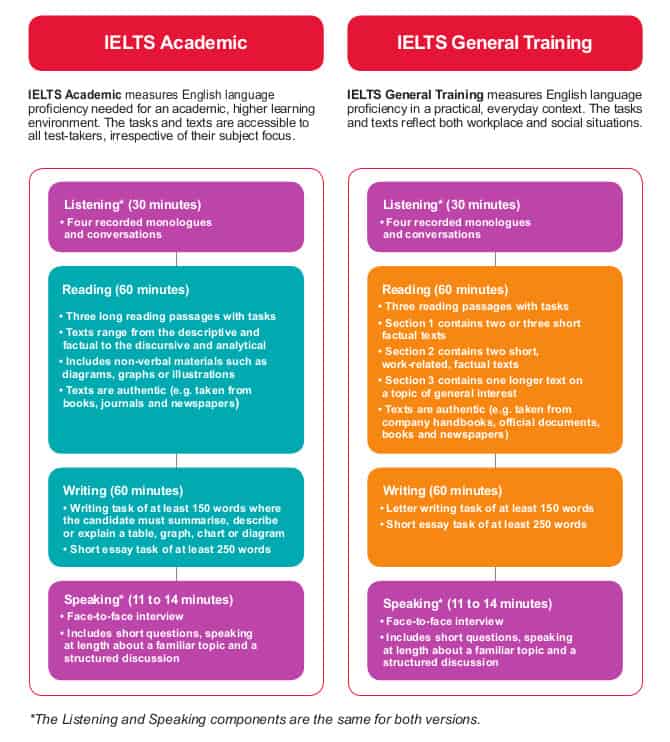

- There are two different versions of the tests: Academic and General Training.

Who should take the IELTS test?

IELTS scores can be required for a variety of reasons. You may need to provide an academic institution with a standardized English test score. Some professional associations require a standardized English test score for official registration purposes. Governments in Australia, Canada, New Zealand, and the United Kingdom specifically require IELTS scores when granting work visas and citizenship.

Which version of the test is right for me?

There are two versions of the IELTS test: Academic and General.

- Academic IELTS is designed for:

- university or college applicants

- those seeking registration in a professional association

- individuals whose strengths are in literacy

- General Training IELTS is designed for:

- those who are planning to study abroad at high school or in a vocational program

- visa requirements for people migrating to Australia, Canada, New Zealand, or the UK

- individuals whose strengths may be in numeracy

Be sure to confirm which version is best for your particular situation, but be sure to consider General Training IELTS if it is an option.

Where do I take the IELTS exam?

The IELTS test is conducted at a test centre. Once you have booked an exam at your preferred test centre, you will need to go to the centre on your chosen date. All parts of the test are conducted at the centre and you will interact with people instead of computers.

How do I register for IELTS?

There are more than 450 IELTS test locations worldwide. More than 90 of these locations are in Canada—click here to find test locations by province.

Outside of Canada—click here to find global test locations.

Most IELTS test centres offer a convenient online booking system that is easy to use. To book online, you will need a clear, colour scan or photo of your passport and a credit card.

Most centres accept online registration, but a few centres will accept paper-based registration forms. To register for IELTS, you will need a valid passport or a Canadian Permanent Resident card if you are in Canada.

The test can be booked online by going to IELTS Essentials and clicking Book.

When can I take the IELTS test?

- There are 48 test dates each year.

- The Academic test is offered on all 48 dates.

- The General Training test is offered on 24 dates.

- Availability at centres may vary depending on local demand.

When can I get my results?

- Results are available 13 days after the test.

- Unofficial results can be viewed online.

- Official results or Test Report Forms (TRFs) are sent to receiving institutions (for example, universities and professional bodies).

- One copy of the TRF will be sent directly to you; or two copies will be sent if you are applying for immigration or visas for Canada and the UK.

- Candidates can request up to five (5) additional TRFs at no cost within 30 days of the test.

- TRFs can be requested at any time within two years of the test date.

- There is a correlation between IELTS scores and Canadian Language Benchmarks (CLB): CLB compared to IELTS score.

IELTS is an important tool to help you demonstrate and present your English language skills that are necessary for academic and migration acceptance. The IELTS system has a network of support and resources to help you with your journey towards achieving your educational and professional goals.

Be sure to read part two of this blog series, Preparing for the IELTS Exam, for info on preparation best practices, access to free test-prep resources, and more.